All Categories

Featured

Table of Contents

Home mortgage life insurance provides near-universal coverage with marginal underwriting. There is commonly no medical exam or blood sample required and can be a useful insurance coverage policy choice for any property owner with serious preexisting medical problems which, would certainly avoid them from acquiring traditional life insurance policy. Other advantages consist of: With a home loan life insurance coverage plan in place, heirs won't have to fret or question what may occur to the family home.

With the home mortgage repaid, the family will always have a location to live, given they can afford the property tax obligations and insurance policy every year. how much is mortgage insurance in california.

There are a couple of various kinds of mortgage security insurance policy, these include:: as you pay more off your home mortgage, the amount that the policy covers minimizes in accordance with the outstanding equilibrium of your home mortgage. It is the most usual and the least expensive kind of mortgage protection - insurance for mortgage in case of death.: the amount insured and the premium you pay continues to be level

This will certainly pay off the mortgage and any type of staying equilibrium will certainly go to your estate.: if you wish to, you can add significant disease cover to your home loan security policy. This indicates your mortgage will certainly be removed not only if you pass away, yet also if you are detected with a major disease that is covered by your policy.

Line Of Credit Insurance Is It Worth It

Furthermore, if there is an equilibrium continuing to be after the mortgage is cleared, this will go to your estate. If you change your home loan, there are a number of points to take into consideration, relying on whether you are covering up or extending your home mortgage, changing, or paying the home mortgage off early. If you are covering up your home mortgage, you require to ensure that your policy meets the brand-new worth of your mortgage.

Contrast the costs and advantages of both alternatives (payment protection life insurance). It might be more affordable to keep your original mortgage protection plan and after that purchase a second plan for the top-up amount. Whether you are covering up your home loan or expanding the term and need to obtain a new policy, you might locate that your premium is more than the last time you obtained cover

Life Cover Mortgage Protection

When changing your mortgage, you can appoint your home mortgage security to the new lender. The costs and degree of cover will be the same as prior to if the amount you borrow, and the term of your home loan does not transform. If you have a policy via your lending institution's group plan, your lending institution will certainly terminate the policy when you change your mortgage.

In California, home loan protection insurance covers the whole outstanding equilibrium of your funding. The death benefit is a quantity equivalent to the equilibrium of your home loan at the time of your death.

Best Home Loan Insurance

It's essential to recognize that the fatality benefit is given directly to your creditor, not your liked ones. This assures that the remaining debt is paid completely and that your liked ones are saved the economic strain. Home loan defense insurance can additionally supply temporary insurance coverage if you become impaired for an extended period (usually 6 months to a year).

There are numerous advantages to obtaining a home mortgage protection insurance plan in California. Some of the leading benefits include: Assured approval: Even if you remain in bad wellness or job in a dangerous occupation, there is assured approval without medical examinations or laboratory examinations. The same isn't real for life insurance policy.

Handicap security: As mentioned above, some MPI policies make a couple of mortgage settlements if you become impaired and can not generate the same earnings you were accustomed to. It is necessary to keep in mind that MPI, PMI, and MIP are all various sorts of insurance coverage. Home mortgage defense insurance coverage (MPI) is designed to pay off a home mortgage in case of your fatality.

Mortgage Payment Insurance Protection

You can even use online in mins and have your plan in position within the very same day. To find out more concerning getting MPI insurance coverage for your mortgage, get in touch with Pronto Insurance policy today! Our well-informed agents are here to address any kind of concerns you may have and offer additional aid.

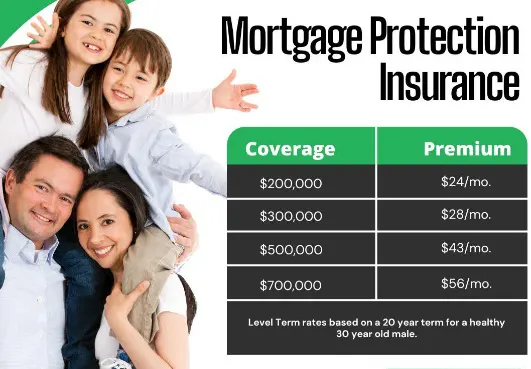

It is advisable to contrast quotes from various insurers to locate the most effective price and protection for your needs. MPI uses numerous advantages, such as assurance and streamlined qualification processes. It has some constraints. The death benefit is straight paid to the lender, which restricts versatility. In addition, the benefit amount lowers gradually, and MPI can be a lot more costly than basic term life insurance policy policies.

Mortgage Insurance And Death

Enter basic details concerning yourself and your home loan, and we'll compare rates from different insurance companies. We'll likewise show you how much insurance coverage you need to shield your mortgage.

The primary benefit here is quality and self-confidence in your choice, recognizing you have a plan that fits your demands. Once you accept the strategy, we'll deal with all the documents and setup, making sure a smooth application procedure. The positive outcome is the satisfaction that includes knowing your family members is secured and your home is secure, regardless of what occurs.

Specialist Recommendations: Support from knowledgeable experts in insurance policy and annuities. Hassle-Free Arrangement: We deal with all the documentation and execution. Cost-Effective Solutions: Locating the most effective insurance coverage at the most affordable possible cost.: MPI specifically covers your home loan, supplying an additional layer of protection.: We work to locate the most economical solutions customized to your budget.

They can provide details on the protection and advantages that you have. Typically, a healthy individual can expect to pay around $50 to $100 monthly for home mortgage life insurance policy. It's suggested to acquire a tailored home mortgage life insurance policy quote to get a precise quote based on individual circumstances.

Latest Posts

Best Final Expense Companies

Final Expense Life Insurance Quotes

Final Expense Insurance Employment